How Fast Does Credit Score Increase – Did you know that making regular, timely payments on your credit cards can improve your credit score? Try online credit counseling, get a free image of your credit report and see if a credit management program is the best solution for you.

Credit scores are one of the most important aspects of your financial health, and raising your credit score opens up a world of possibilities. Unfortunately, it takes time, but there are things you can do to pay off the line today.

How Fast Does Credit Score Increase

Lenders use credit scores to judge your ability to repay a loan. Getting your credit score somewhere north of 700 means you qualify for lower interest rates and better terms on any loans you take out. Hit a score above 750 and you should qualify for the best rates the broker has to offer.

How To Increase Your Credit Score: 6 Easy Tips

A low average score has the opposite effect. You may not qualify for a loan to buy an essential car, home or insurance for someone. In fact, if you have a bad credit score you can be denied housing, utilities and pay extremely high interest rates on credit cards.

So, a good score – at least 700 or better – is important. Here are some steps you can take today to get there.

The fastest way to improve your credit score is to stop using your credit cards and pay off the balance on each one. There is nothing better than paying regularly every month, except twice a month.

Don’t be afraid to contribute a portion of each check to reduce the balance of all debts, especially credit cards.

Credit Score: 4 Tips That Can Help To Increase Your Cibil Score

If you can get the balance on each card to less than 30% of the available limit (for example, less than $300 on a credit card with a $1,000 credit limit), your credit score will start to rise. If you can get the balance to zero, your score will go up.

If you missed a payment, wait. If needed, set up automatic reminders when payments are due. Or better yet, set up automatic payments from your bank account. Making payments on time each month is the most important aspect of improving your credit score and the easiest to control. Card companies reward customers who are reliable with payments and penalize those who are not.

Don’t close accounts with cards you no longer use. This will negatively impact your credit utilization rate and the average age of your accounts, two key factors that determine your credit score.

:max_bytes(150000):strip_icc()/6-benefits-to-increasing-your-credit-limit.aspx-Final-3e39f0c2ff2849e99e00473e4027810e.png?strip=all)

Keep accounts open and keep making payments to reduce balances. The only reason to cancel a card is if an annual fee or other transaction fee has been added to your credit.

Ways To Boost Your Credit Score Fast

Monitor your credit report to make sure there are no errors that could lower your score. Mistakes can send the wrong signal to lenders that you’re not trustworthy, but in reality, bad credit isn’t about you. To check for errors, you can request an annual credit report from annualcreditreport.com. All three credit reporting agencies, Experian, Equifax and TransUnion, must each provide you with a free credit report each year.

Monitoring your credit report can also alert you to identity theft if you see charges that don’t exist. Be sure to dispute the debt with creditors, debt collectors and reporting agencies if they are at fault.

Don’t apply for another credit card unless you really need it. Do not pay off one credit card with another. It is also bad to open too many accounts in a short period of time.

If you have past due bills, check with the creditor to see if they accept partial payments. If they do, ask the creditor to report the account as “paid as agreed.”

What Is A Good Credit Score?

Call your credit card company and request a higher spending limit. This will reduce your credit utilization and make it easier to stay under the 30% spending limit recommended for card users. Ask the issuer to do a “soft pull” on your credit report to complete it. If you’re a regular payer, this should be an easy way to improve your score.

If you want to take these steps but don’t see how to go about it, call a nonprofit credit counseling agency and ask for help creating a debt repayment plan.

This book provides practical advice on how to improve your credit score by improving your on-time payment history, disputing false information, reducing your credit utilization and maintaining a credit card. And how to improve your credit report. Implement these tips today and watch your score improve.

If you’re in a hurry to improve your credit score, it’s wise to understand the negative effects on your credit report and how long they will last.

The 5 Biggest Factors That Affect Your Credit

Most negative effects on your credit report last up to seven years, although their impact on your credit score diminishes over time. In other words, it is worth less in the fifth, sixth and seventh years than in the first three years.

The worst impact on a credit score is late payments, especially those that go to a collection agency. This is an unknown, but equally bad exception found in debts listed in public records such as bankruptcy and tax filings. Chapter 13 bankruptcy has been on your record for seven years. Chapter 7 bankruptcy lasts for 10 years.

Tax credits are a slightly different story. They can stay on your credit report for up to seven years after payment. However, the IRS will allow its tax paying customers to request immediate removal from tax reports.

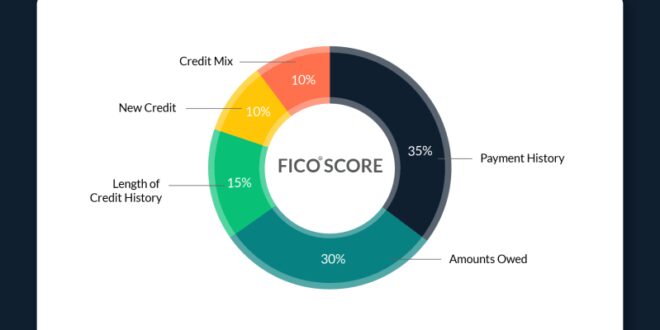

FICO, or Fair Isaac Corporation, is the nation’s oldest and most trusted credit score issuer. More than 90% of businesses use the FICO score to verify a customer’s creditworthiness.

How To Increase Your Credit Score

The FICO score is three numbers that tell lenders how likely you are to repay your loan on time. Unlike your weight or age, the higher the number, the happier you are.

A score of 800-850 is considered good. 740-799 Very good; 670-739 good; 580-669 is good and anything below 580 is bad.

You can increase your score using the steps shown above, but it’s not easy. If the idea bothers you, blame William Fair and Earl Isaac, the founders of the scoring system. He was a digital engineer who created the first credit monitoring system in 1956.

Fair, Isaac and Company was eventually shortened to FICO, and is the way information goes for the three major credit reporting agencies: Equifax, Experian and TransUnion. The evaluation methods of the three bureaus are slightly different, but the final numbers reflect your creditworthiness.

What Are The 7 Best Ways To Increase Your Credit Score

The final numbers are all based on algorithms only head-turning professors like Fair and Isaac understand, but here’s what you need to know: Your age, race, religion, gender, marital status, address, income and work history are irrelevant. .

Lenders can use this information, especially income and work history, to calculate their scores when they rate some of these and other criteria to decide whether to lend to you. But FICO’s algorithm doesn’t care.

Only credit issues are considered. Your credit card history, mortgage and other public records such as bankruptcies, foreclosures, delinquencies and liens. They depreciate over time, but bankruptcy stays on your credit for 7-10 years.

This is about thirty-five percent of your grade. Did you pay your loan on time? Not paying late doesn’t mean you’ll get a perfect score, however, since 60-65 percent of credit reports don’t have late payments, it’s considered a very good thing.

How To Increase Your Credit Score And Build Credit

This includes the amount you owe and the percentage of your credit limit that you use. For example, if you have $7,200 on a Visa card with a $10,000 limit, your “credit utilization” is 72%. Experts recommend that you limit the use of debt to less than 30 percent of $3,000.

Having a high balance indicates that you are paying more. Some people believe that they have to have a balance to build credit. This is a myth. Paying off the loan early will help your score. Balancing will hurt.

The more credit you use, the better. That’s why closing an old account can hurt your credit score. Credit bureaus smile when they see someone who has been using it faithfully for a long time.

Consolidation of credit cards, payday loans, mortgages and other payments. The more types of loans you have, the better, as long as you make your payments on time.

How To Raise Your Credit Score: Proven Strategies To Repair Your Credit Score, Increase Your Credit Score, Overcome Credit Card Debt And Increase Your Credit Limit Volume 1 By Income Mastery

Everyone has to start somewhere, but opening new credit accounts too soon is a red flag. In other words, don’t apply for more than one or two credit cards at a time and make sure you keep your old card open even if you get new cards. The average length of time you have credit cards is important.

Yes, you can consolidate your bad debt payments by adopting a debt settlement alternative such as a nonprofit debt management program.

Good credit saves you money by lowering interest rates if you want a mortgage.

How fast credit score increase, how fast does my credit score increase, how to increase your credit score fast, increase credit score fast, how fast can my credit score increase, how fast can credit score increase, how to increase credit score fast, increase your credit score fast, increase my credit score fast, how to increase my credit score fast, how fast can you increase credit score, how fast can your credit score increase