Crypto Otc Trading Platform Login – There are many crypto OTC desks, but only a few have the money and reputation of world-class exchanges. Below is our selection of the best crypto OTC desks.

From Coinbase, the largest US cryptocurrency exchange, comes their OTC offering: Coinbase Prime. The platform leverages Coinbase’s stellar reputation for making trading services accessible to institutions and large traders.

Crypto Otc Trading Platform Login

In their words, Coinbase Prime is “designed for asset managers, hedge funds, VCs, foundations, private equity, private wealth managers and private equity funds.”

Benefits Trading Usd Through Otc

The exchange also provides certain features not usually supported by OTC exchanges, including safe custody of NFT assets and participation in the holding and management of backed tokens.

Kraken is a large cryptocurrency exchange known for its wide range of features and large markets. Kraken OTC is the company’s institutional trading platform.

The Kraken OTC service supports the trading of all coins supported on Kraken’s native exchange. The platform uses a Request-For-Quote system that allows sellers to enter the price, time and details of their trade and is matched individually with a contractor willing to execute the trade.

Like other exchanges, Kraken OTC also offers 1 on 1 customer service and 24/7 support for traders.

Krypto Otc: Wie Funktioniert Otc Trading?

Acting as a hybrid between Wall Street and Silicon Valley, FalconX is a professional OTC exchange for institutions and major crypto managers.

FalconX uses machine learning and data science to provide the best value to its customers. The platform focuses on providing credit and clearing services to large institutions, allowing them to take margin positions and trade them all in one place.

Binance is the largest cryptocurrency in the world by trading volume. They have an excellent reputation in the crypto community for deep funds, a variety of supported assets, and extensive documentation to help new traders get started.

The Binance OTC desk shines with daily trading support. This is a very rare feature in the world of OTC platforms, as most require an extensive verification process with a strict minimum portfolio value.

Over The Counter Trading Services For Your Crypto

Binance’s OTC offering gives regular traders the ability to adjust their trades and receive individual trade offers not available on regular exchanges.

The Crypto.com juggernaut brings together an exchange, wallet, NFT market and token platform with its OTC offering to major traders. The platform’s OTC desktop is only available to institutional and VIP clients.

Crypto.com uses a request for quotation (RFQ) system to automatically match buyers and sellers. This allows the platform to process transactions quickly, unlike the manual currency matching that occurs on many other OTC desks.

Genesis was the first OTC crypto trading platform launched in 2013. Since its inception, it has been the go-to place for institutions and high-net-worth individuals who want to make big crypto trades.

Best Crypto Otc Trading Platforms In Australia 2023

In turn, they handled over $110 billion in trading volume, $130 billion in loans and $53 billion in derivatives trading 100+ digital currencies by 2021.

Genesis offers its clients a white glove service, deep trading, fast order execution and advanced trading options. The platform has a good reputation in the crypto community and is widely considered for OTC trading.

Do you want more data to help you make trading decisions? Check out our guide to the best crypto analysis tools.

The main mode of trading for daily retail investors is crypto exchange. OTC trading is a modified version of exchange trading with a higher touch service, more money and often provides 1-on-1 support.

Otc Exchange Platform Development Company

Usually higher, there may be several different types of payments that are often different from the actual value of the transaction.

While using regulated, established platforms reduces the risk of OTC trading, like any other crypto, there are still some risks to consider:

Most OTC desks go to great lengths to ensure the safety of the client’s assets in their custody. As with anything digital, security can be compromised. Here is a list of security features to look for when choosing an OTC Desktop:

Let’s say you want to make a $1 million trade when you buy Bitcoin for USD. Such large trades are best done at the OTC desk to get the best price and secure your order without any hassle.

The Block: Wintermute Launches Institutional Crypto Otc Trading Platform

You decide to use Kraken’s OTC desk to make these trades because of their 1-1 service and support for direct fiat trades from USD. You contact your account representative and let them know that you want to complete the purchase of $1 million worth of Bitcoin as soon as possible. Depending on the market, your trade may be ready to execute immediately, or you may have to wait a few days for your broker to find the funds you need at the best price.

Once you get the money you need, your trade is done seamlessly and without additional fees. Fees on Kraken are calculated at the time of the quote, so the estimate given to your account representative is the full price, excluding hidden fees.

OTC desks are used for large trades, usually by financial institutions or high net worth individuals. OTC trading allows anonymity and offers the best rates for various trades. These platforms often provide white glove services to clients who meet their strict trading needs. We strive to provide liquid markets not only for Bitcoin, but for the entire crypto space, including altcoin markets, which are an integral part of the blockchain. ecosystem.

There is a common misconception that OTC trading is the only gateway to crypto. For those who know how to use the OTC market effectively, there is actually a lot more to be gained from it than simply using it to trade fiat BTC and vice versa. In this post, we hope to explain why OTC trading is beneficial to the market and how trading can help you make crypto, especially alt-coin trading, easier.

Case Study: Why Choose Xerof’s Otc Exchange

(However, if you want a quick and cheap way to enable/disable the ramp between fiat/crypto, this can now be done with ease or close to zero cost with stablecoins – for more information, I recommend you. check out our previous article on stablecoins https :// /en/blog/294416239327625216/Stablecoins-An-Efficient-Fiat-Gateway-Into-Crypto)

When you trade in cryptocurrencies, there are two main ways to do it – on an exchange or over the counter (OTC).

Exchanges (like) serve as marketplaces that generate income from traders around the world. On an exchange, you can see the entire order book (list) of bids (where people want to buy) and offers (where people want to sell). You can see exactly how much you can buy or sell at each price, and each trade is clearly posted for all to see. The exchange takes care of wallet management, security, KYC/AML and provides a safe and convenient platform for users to trade.

In general, trading in the stock market is good because it is simple and transparent. The problem with trading in the stock market is that sometimes this transparency makes it difficult to trade large amounts at once without the markets moving too much.

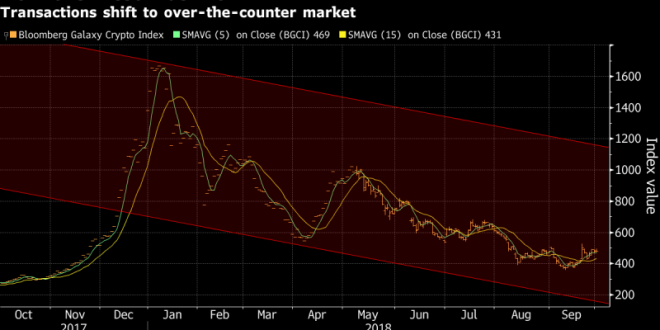

Dark Pool And Otc Crypto Trading Growing As Market Begins To Resemble Traditional Asset Classes

For example, if you want to buy 50,000 MATIC (about 485 USDT), you can do it immediately on the exchange and pay 0.0097 USDT per MATIC. But if you want to buy 1,000,000 MATIC (about 9,700 USDT), only 78,794.8 MATIC is available at 0.0097, which means you will have to pay a higher price than all other coins. To reach 1,000,000 MATIC, your last MATIC will cost you 0.00985, or a full 1.5% above the current market price. And that’s only 10,000 USDT. If you wanted to buy 100,000 USDT or more, it wouldn’t make sense to buy it all at once from an exchange.

Alternatively, you can place your large order as a limit order. But this can take a very long time to fill, and simply placing a large buy limit order can drive prices up because it is a signal to other traders that someone wants to buy a large amount. This can cause the market to ‘run away’ from you and force you to review your limits regularly, meaning you are still buying at the original market price (after a lot of extra effort!).

Unlike over-the-counter trading, OTC trading takes place directly between two counterparties. This is an easy way to trade a large block of coins at once. Each trade is a two-way agreement between the buyer and the seller – no one else sees the conversation, allowing you to discuss large trades without fear of impacting the market. Trading can be as simple or as customized as you like.

OTC trading gives you access to a deeper pool of income than is immediately available from an exchange’s order book. Simply put, it allows you to trade in large blocks (typically 20 BTC and more).

Institutional Crypto Trading Platforms: Blockchain Meets Block Trade

Crypto day trading platform, crypto trading platform, best copy trading platform crypto, best otc trading platform, best crypto day trading platform, best crypto algo trading platform, automated trading platform crypto, crypto algo trading platform, otc trading platform, best online crypto trading platform, best crypto trading platform, best otc stock trading platform

Originally posted 2023-05-17 21:10:36.