Best Trading Strategy For Beginners – A forex trader can create a simple trading strategy to take advantage of trading opportunities using only a few moving averages (MAs) or related indicators. MA is primarily used as a trend indicator and also identifies support and resistance levels. The two most common MAs are the simple moving average (SMA), which is the average price over many time periods, and the exponential moving average (EMA), which gives more weight to recent prices. Both form the basic framework of the forex trading strategies below.

This moving average trading strategy uses the EMA, as such averages are designed to react quickly to price changes. Here are the steps to the strategy.

Best Trading Strategy For Beginners

Forex traders often use the short-term MA crossover long-term MA as the basis of a trading strategy. Play around with different MA lengths or time frames to see what works best for you.

Moving Average Strategies For Forex Trading

Moving average envelopes are envelopes based on percentages placed above and below the moving average. The moving average set as the base of the envelope does not matter, so forex traders can use a simple, exponential or weighted MA.

Forex traders should test different percentages, timeframes and currency pairs to understand how they can best apply the envelope strategy. Often one looks at the envelope over a 10- to 100-day period and uses “bands” that range from 1-10% to the moving average for daily charts.

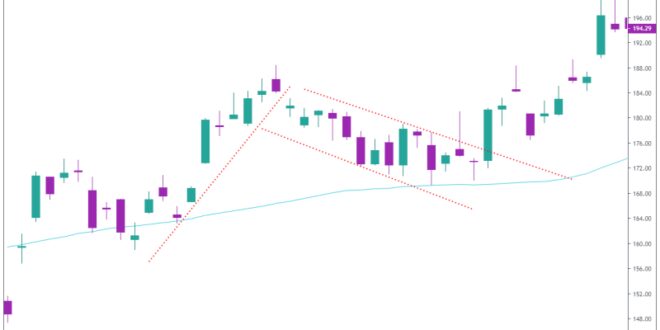

If day trading, the envelope will often be much less than 1%. In the one minute chart below, the MA length is 20 and the envelopes are 0.05%. Settings, especially percentages, may need to change from day to day depending on volatility. Use settings that match the strategy below with the daily value.

Ideally, only trade when there is a strong overall price bias. After that, most traders only trade in that direction. If the price is in an uptrend, consider buying when the price approaches the middle area (MA) and then starts to rise from there. In a strong downtrend, consider shorting when the price approaches the middle band and then begins to decline away from it.

The Best Forex Trading Strategies

Once the short is made, place a stop-loss one pip above the recent high just made. When executing a long trade, place a stop-loss one pip below the low just made. Consider exiting when price reaches the lower range in a short trade or the higher range in a long trade. Alternatively, set a goal that is at least twice as risky. For example, if you are risking five points, set the target 10 points away from entry.

A moving average bar can be used to create a basic forex trading strategy based on a slow reversal of a trend change. It can be used with a trend change in either direction (up or down).

The creation of moving average bars is based on the belief that moving averages are better at charting. A bar consists of 8 to 15 exponential moving averages (EMAs), from very short-term to long-term averages, all plotted on the same chart. The resulting bar average is intended to provide an indication of both trend direction and trend strength A steeper angle in the moving average—and a greater separation between them, which makes the band wider or wider—indicates a stronger trend.

Traditional buy or sell signals for a moving average bar are the same type of crossover signals used with other moving average strategies. There are many crossovers involved, so the trader must choose how many crossovers represent a good trading signal.

What Is The Best Day Trading Strategy And Why?

An alternative strategy can be used to provide low-risk trade entries with high profit potential. The strategy described below aims to catch a decisive market breakout in either direction, which often occurs after the market has traded in a narrower and narrower range for an extended period of time.

The moving average convergence histogram (MACD) shows the divergence between two exponential moving averages (EMA), the 26-period EMA and the 12-period EMA. Additionally, the nine-period EMA is plotted as an overlay on the histogram. The histogram shows positive or negative readings relative to the zero line. Although most commonly used in forex trading as a momentum indicator, MACD can also be used to indicate market direction and trend.

Guppy Multiple Moving Average (GMMA) consists of two separate sets of exponential moving averages (EMA). The first set contains EMAs for the previous three, five, eight, 10, 12 and 15 trading days. Daryl Guppy, Australian trader and inventor of the GMMA, believed that this first set indicated the mood and direction of short-term traders. The second set consists of EMAs for the previous 30, 35, 40, 45, 50 and 60 days; If the nature of a particular currency pair requires an adjustment to compensate, the long-term EMA is modified. This second set should show long-term investor activity.

If the short-term trend does not seem to find any support from the long-term average, it may be a sign that the long-term trend is tiring. See the bar technique above for a visual. With the Guppy system, you can create short-term moving averages in one color and all long-term moving averages in another color. Look for two sets of crossovers, like tapes. When the short moving averages begin to cross below or above the long-term MA, the trend may reverse.

Trading Strategies That Work

Authors must use primary sources to support their work. These include white papers, government data, original reports and interviews with industry experts. Where necessary, we also cite original research by other renowned publishers. You can learn more about the standards we follow in creating accurate, unbiased content in our editorial policy.

The offers shown in this table are from compensation partnerships. This compensation can affect how and where ads are displayed. Does not include all offers available in the market. We use a variety of cookies to provide you with the best possible browsing experience. By continuing to use this website, you consent to our use of cookies.

You can find out more about our cookie policy here or by following the link at the bottom of any page on our website. See our updated privacy policy here.

EUR/USD Price Forecast: Euro May Be Temporary 2023-09-04 07:30:09 EUR/USD Price Forecast: Euro Risk Will Accumulate Before NFP 2023-08-31 15:42:12

Day Trading For Beginners: The Ultimate Guide To Profit With Short Term Trading On Different Financial Markets. Master Etfs, Stocks, Futures And Forex Through The Strategies Of The Best Traders By Matthew Ray

Crude oil is flying higher, and markets are expecting a Fed break. Will WTI go higher? 2023-09-04 05:00:00 US holiday, but focus could be on China, Russell 2000, USD/JPY and Brent crude 2023-09-04 02:00:00

US Holiday, But Focus May Be China, Russell 2000, USD/JPY and Brent Crude 2023-09-04 02:00:00 Stock rally continues; FTSE 100, Nasdaq 100, Dow Jones 2023-08-30 09:30:45

Gold stumbles after European Open, silver continues to sell off, where next? 2023-09-04 11:00:00 Markets ahead: US Dollar, Gold, Crude Oil, AUD/USD, USD/CAD, RBA, BoC 2023-09-03 17:00:00

British Pound Outlook: GBP/USD Head and Shoulders, EUR/GBP Support Zone in Focus 2023-09-03 23:00:00 British Pound Latest: GBP/USD Weak on Weekend, EUR/GBP Little Changed 2023-09-01 15 :45 :15

Day Trading Strategies For Beginners 2023

The slide of the Japanese yen pauses, but for how long? USD/JPY, EUR/JPY, MXN/JPY Price Settings 2023-09-04 03:30:00 US holiday, but focus on China, Russell 2000, USD/JPY and Brent Crude 2023-09-04 02:00:00

A forex trading strategy defines the system a forex trader uses to determine when to buy or sell a currency pair. There are various forex strategies that traders can use including technical analysis or fundamental analysis. A good forex trading strategy allows the trader to analyze the market and execute trades confidently with good risk management strategies.

Forex strategies can be divided into a specific organizational structure that can help traders identify the most applicable strategies. The diagram below illustrates how each strategy fits into the overall framework and relationship between forex strategies.

Forex trading requires combining multiple factors to formulate a trading strategy that works for you. There are countless techniques that can be followed, however, it is essential to understand and be comfortable with the technique. Each trader has unique goals and resources, which must be taken into account when choosing an appropriate strategy.

How To Use A Moving Average To Buy Stocks

To easily compare Forex strategies based on the three criteria, we have put them in a bubble chart. At the top of the ‘Risk-Reward Ratio’ chart on the vertical axis are strategies with higher rewards for the risk taken on each trade. Position trading is usually the strategy with the highest risk reward ratio. The horizontal axis contains time investment, which represents the amount of time required to actively monitor trades. Scalp trading is the most demanding strategy in terms of your time resources due to the high frequency of trades made on a regular basis.

Price trading studies historical prices to formulate technical trading strategies. Price action can be used as a standalone strategy or in conjunction with an indicator.

Best stock trading for beginners, best online trading for beginners, best forex trading strategy for beginners, best stock trading strategy for beginners, best option strategy for beginners, best trading app for beginners, best trading platform for beginners, best trading platforms for beginners, best trading for beginners, forex trading strategy for beginners, best trading account for beginners, best investing strategy for beginners

Originally posted 2023-09-04 12:08:30.