Best Otc Stock Trading Platform – In the volatile world of penny stock trading, using the best penny stock trading software to order and manage your trades is very important.

For 2018, these are the two best brokers with free trading platforms that are very suitable for trading penny stocks. Both of these platforms (TradeStation Pro and Zacks Trade) are downloadable, customizable and easy to use.

Best Otc Stock Trading Platform

Zacks Trade has no platform or inactivity fees and offers full depth Level 2 market quotes on penny stocks worldwide. In addition, they have a large selection of stocks that are difficult to borrow for traders who want to bet against the market.

Best Penny Stock Trading Platform 2023 2023 Reviewed

Second only to Zacks Trade, TradeStation offers an impressive stock trading platform. The TradeStation platform can handle everything from complex order types to finding new penny stocks based on intraday volume and market limits.

It’s hard to go wrong with TradeStation or Zacks Trade, but professional traders or full-time traders may appreciate the powerful trading platform and free broker-assisted trades that Zacks Trade offers, and TradeStation may be easier to manage than TradeStation- om for the first time.

Since a lot of penny stock trading involves shorting penny stocks, ie betting against the current price, you need to make sure your trading platform is on point, but you also need to make sure your broker has good credits available.

This is why I recommend that you have accounts with both Zacks Trade and TradeStation, as sometimes one broker will short a particular penny stock and sometimes the other broker will not.

Best Day Trading Platforms, Apps, & Sites In 2023

Since there are no inactivity or account maintenance fees with any of these brokers, having two accounts and access to two phenomenal stock trading software platforms won’t hurt your trading.

You can bet Penny stocks are some of the most volatile stocks in the entire market. However, this is a double-edged sword. Every time there is volatility there is opportunity. With market capitalization (the total value of a company) typically less than a few $50 million, small buy and sell orders can have dramatic effects on market prices.

If bullish news comes out for penny stocks, such as FDA approval, earnings declines, etc., there’s no telling how much the stock could rise. In 2015, a trader was short KBIO, held his position overnight, and the next morning the stock opened up more than 300%.

Since the trader is short, he has to buy back his shares, but almost everyone is struggling to get hold of some shares. Long story short, his trading account went negative by over $100,000.

What Is Over The Counter (otc)?

Make no mistake, penny stocks are not like ordinary blue-chip buy-and-hold investments. Penny stocks move fast and fast, so you need to use a trading platform that can keep up – seriously.

Imagine you are missing a stock like KBIO, you are trying to close your position, but your stock trading software freezes and stops responding. It’s all fun and games until your trading software catches up and causes a losing trade.

TradeStation and Zacks Trade offer professional, reliable platforms at no additional cost. Responsible traders must use the best possible software. Over-the-counter (OTC) is the process of trading securities through a network of broker-dealer companies as opposed to a centralized exchange such as the New York Stock Exchange.

OTC trading can include stocks, bonds and derivatives, which are financial contracts that derive their value from an underlying asset such as a commodity.

The 6 Best Options Trading Software & Tools

When companies are not eligible to be listed on a common market exchange such as NISE, their securities may be traded OTC, but may still be subject to some regulation by the Securities and Exchange Commission.

Stocks that trade over the OTC are usually smaller companies that do not meet the listing requirements of formal stock exchanges. Many other types of securities also trade OTC.

Stocks that are traded on stock exchanges are called listed stocks, while stocks that are traded through the over-the-counter market are called unlisted stocks.

Trade transactions can take place through OTC Markets Group’s electronic settlement platforms: OTCKKS; OTC KB; and Pink Open Market, also known as OTC Pink or “Pink Sheets”.

Best Investment Apps For Singapore (2023 Update!)

FINRA operated an OTC exchange known as the OTC Bulletin Board (OTCBB), but FINRA officially ceased operations of the OTCBB in November. 8, 2021.

Stocks that trade over the over-the-counter market are mostly small companies that are barred from listing at $295,000 on the NISE and up to $75,000 on the Nasdaq. Some well-known large companies are listed on OTC markets, such as Allianz SE, BASF SE, Roche Holding Ag and Danone SA.

Bonds are not traded on an official stock exchange, but are sold by banks through broker-dealer networks and are also considered over-the-counter securities.

Derivatives are private contracts arranged by a broker and can be unique options, forwards, futures or other contracts whose value is based on an underlying asset, such as a stock.

How To Buy Otc Stocks • • Benzinga

American Depositary Receipts (ADRs), sometimes called ADSs or bank certificates representing a certain number of shares of foreign stock.

OTC Markets Group operates some of the most famous networks, such as Best Market (OTCKKS), Venture Market (OTCKB) and Pink Open Market. Although OTC networks are not formal exchanges like NISE, they still have eligibility requirements set by the SEC.

The OTCKKS does not list stocks that sell for less than five dollars, known as penny stocks, shell companies, or loss-making companies. OTCKKS comprises only 4% of all traded OTC stocks and requires the highest reporting standards and strictest SEC oversight.

This includes foreign companies listed on foreign exchanges and some US companies. which plans to list on NISE or Nasdaq in the future.

Best Stock Chart Apps, Software & Websites In 2023 [free & Paid]

The OTCKB is often referred to as an “investment market” with a concentration of emerging companies that must report their financial information to the SEC and undergo some oversight.

OTC Pink Sheets are the riskiest level of OTC trading with no financial reporting or registration requirements with the Securities and Exchange Commission. Some legitimate companies exist on the Pink Sheets, however, there are many fictitious companies and companies with no real business listed.

Although Nasdaq operates as a dealer network, Nasdaq stocks are generally not classified as OTC because Nasdaq is considered a stock exchange.

Bonds, ADRs and derivatives are traded over-the-counter, however, investors face greater risk when investing in more speculative OTC securities. Filing requirements between listing platforms vary and business finances can be difficult to find. Most financial advisors consider trading OTC stocks to be a speculative activity.

Over The Counter Trading

In general, OTC-traded stocks are not known for high trading volume. Lower stock volume means there may not be ready buyers when it comes time to trade the stock. Also, the spread between the bid price and the ask price is usually larger because these stocks can make volatile moves with any market or economic data.

The OTC market is an alternative for small companies or those unwilling or unable to list on conventional exchanges. Listing on a common stock exchange is an expensive and time-consuming process and beyond the financial capabilities of many smaller companies. Companies may also find that listing on the OTC market provides quick access to capital by selling shares.

The OTC market is generally considered risky, with lax reporting requirements and lower transparency regarding these securities. Many stocks traded over the counter have lower share prices and can be highly volatile. While some stocks in the OTC market were eventually listed on major exchanges, other OTC stocks failed. As with any investment, it’s important to research stocks and companies as thoroughly as possible.

The over-the-counter market is a market where financial securities are traded through a broker-dealer network, as opposed to a financial exchange. The over-the-counter market is not centralized and occurs between two parties, such as a trade that occurs between two individuals buying and selling shares of an unlisted company. The OTC market can consist of any security, such as stocks, commodities and derivatives.

Pink Sheet Stocks: Is It Worth Trading Them? And If So, How?

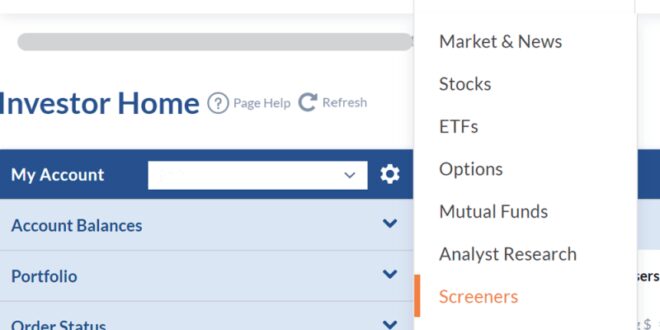

To buy a security in the OTC market, identify the specific security you want to buy and the amount to invest. OTCKKS is one of the largest and most respected markets for OTC stocks. Most brokers that sell securities on the exchange also sell OTC securities and this can be done electronically on the broker’s platform or over the phone.

An OTC derivative is any derivative of a security traded on the OTC market. A derivative is a financial security whose value is determined by an underlying asset, such as a stock or commodity. The owner of the derivative does not own the underlying asset, but in the case of certain derivatives, such as commodity futures, it is possible to deliver the physical asset after the derivative contract expires. In addition to futures, other derivatives include forward contracts and swaps.

Otcmkts, or OTC markets (over-the-counter markets), are markets in which securities are traded that are not listed on major US exchanges. OTC securities are traded through the broker-dealer network often because they do not meet the requirements of the main company

Best stock trading platform for beginners, penny stock trading platform, otc trading platform, stock trading platform, best otc trading platform, best online stock trading platform, otc trading platform uk, crypto otc trading platform, best stock option trading platform, best trading platform for otc stocks, cryptos otc trading platform limited, best stock trading platform

Originally posted 2023-08-02 09:58:33.